Future-Ready CFO Solutions for Growth-Focused Businesses

tecHindustan delivers expert financial strategies designed to drive profitability, minimize risk, and fuel sustainable growth.

tecHindustan delivers expert financial strategies designed to drive profitability, minimize risk, and fuel sustainable growth.

Take control of your business finances with expert CFO strategies that align with your unique goals. Achieve financial clarity, optimize your cash flow, and make well-informed decisions that boost profitability, reduce risk, and promote sustainable growth.

Gain full control over your finances with data-driven budgeting that optimizes resource allocation, reduces inefficiencies, and enhances profitability, ensuring long-term financial stability and sustainable growth.

Maintain financial stability with precise cash flow planning, ensuring smooth daily operations, timely payments, and strategic fund allocation to support business expansion and long-term financial success.

Unlock growth opportunities with expert financial analysis, identifying key trends, risks, and strategic advantages to empower confident, data-backed decision-making for long-term success.

Our customized CFO-led fundraising strategies confidently attract investors, optimize your capital structure, and fuel business expansion, all while preserving financial sustainability.

Strengthen stakeholder trust with clear, data-driven financial reports that enhance transparency, support strategic discussions, and improve decision-making at board meetings and investor presentations.

Maximize business value with expert exit strategies, ensuring seamless transitions, optimized deal structuring, and a profitable outcome for stakeholders during mergers, acquisitions, or business sales.

Building a solid revenue model is crucial for sustainable business growth. tecHindustan’s expertly designed template lets you plan revenue scenarios, optimize cash flow, and confidently make data-driven financial decisions.

Unlock strategic growth, smarter funding, and investor-ready financial leadership with our forward-thinking CFO advisory solutions.

We provide expert CFO oversight to align your business strategy, optimize cash flow, and drive sustainable growth with data-backed decision-making.

From budgeting to forecasting, we create customized financial roadmaps that help businesses mitigate risks, seize opportunities, and ensure long-term financial stability.

Maximize your company’s value with a carefully crafted exit strategy. Our experts ensure smooth transitions and secure optimal financial outcomes.

Enhance investor confidence with transparent financial reporting, strategic insights, and effective communication that builds trust and fosters stronger investor relationships.

Secure the capital you need with expert-driven fundraising strategies, connecting you with the right investors to fuel business expansion.

Navigate mergers and acquisitions confidently with our strategic guidance, ensuring smooth deal execution and business integration for maximum value.

Our outsourced CFO services deliver financial clarity and strategic insights, ensuring your business remains profitable, compliant, and primed for growth.

Leverage expert financial strategies to expand your business, maximize returns, and optimize performance.

Stay ahead with accurate financial reporting and readiness for audits or investor funding opportunities.

Leverage top-tier accounting tools and ERP solutions for seamless financial management and forecasting.

Ensure compliance with tax laws and industry regulations while proactively managing financial risks.

Access top-tier financial expertise without the expense of a full-time CFO.

Customize CFO services to fit your evolving business needs, from startups to growing enterprises.

Businesses can rely on tecHindustan’s CFO services for expert financial guidance without the cost of a full-time CFO, ensuring smart decisions and sustainable growth.

Secure funding and scale effectively with expert financial planning and investor-ready strategies.

Get high-level financial expertise without the commitment of a full-time CFO, keeping your business agile and cost-efficient.

Enhance your existing finance team by outsourcing complex financial tasks to experienced CFO professionals.

Utilize CFO expertise effectively during significant transitions such as mergers, acquisitions, or business restructuring.

Utilize CFO expertise effectively during significant transitions such as mergers, acquisitions, or business restructuring.

tecHindustan made things so simple. Their streamlined process and sharp financial acumen have led this process effortlessly, without us having to worry about it.

Couldn’t have asked for more!

Synergy Enterprises

I never thought these simple financial tasks were eating away my time and resources like anything.

The moment I delegated this responsibility to techHindustan, I freed up a significant amount of time for my other important tasks, which led me to succeed in multiple ventures.

I highly recommend their services!

CEO, Medistik

tecHindustan has completely transformed the way we handle payroll. What used to be a time-consuming and stressful process is now smooth and hassle-free. Thanks guys!

CEO, Emerald Planet

Outsourcing payroll to tecHindustan was the best decision ever. It not only took the workload off our plate but also ensured greater precision and efficiency.

Creative Minds Agency

Empower your business with advanced financial management. From expert virtual bookkeeping services to strategic financial guidance, we provide the tools and insights you need to thrive in today’s digital economy.

Leverage technology and business intelligence to drive smarter decision-making. Our solutions include automated reporting, data-driven forecasting, and real-time analytics, helping you optimize financial performance and stay ahead in a competitive market.

Maintain financial accuracy and compliance with ease. Our accounting solutions ensure audit-ready financial reporting, error-free reconciliation, and seamless compliance management to support your business growth.

Take the guesswork out of taxes. Our expert services optimize your strategy, maximize benefits, and minimize liabilities, giving you peace of mind.

Streamline your payroll with accurate and compliant processing that ensures your team gets paid on time every time without the stress.

We’ve clarified your common questions to help you make informed decisions and have a hassle-free experience.

Outsourced CFO services offer expert financial management without the need for a full-time hire. These services cover budgeting, cash flow management, forecasting, and financial strategy, helping businesses optimize resources, reduce risks, and maintain long-term financial stability while staying cost-effective and agile.

Startups looking to raise capital, small businesses needing expert financial oversight, and medium to large enterprises preparing for M&A or exits all benefit from our services. We customize financial leadership based on your stage, goals, and industry.

We develop investor-ready financial models, optimize your capital structure, and guide you through every phase of fundraising. Our CFOs also help you identify the right investors and communicate financial performance with clarity and confidence.

Yes, our CFO team builds detailed budgets and dynamic forecasts that align with your business model. We help allocate resources wisely, reduce inefficiencies, and improve predictability in your financial planning.

We go beyond tracking numbers—we build proactive cash flow strategies that ensure daily operational smoothness, on-time vendor payments, and smart fund allocation to fuel expansion and stability.

We prepare clear, visually-driven reports and insights that simplify complex data for board members and investors. From quarterly reviews to strategic presentations, we help you speak the language of stakeholders with confidence.

We’ve supported businesses across SaaS, D2C, fintech, manufacturing, healthcare, and professional services. Each solution is customized to your industry’s KPIs, cash cycles, and regulatory landscape.

Absolutely. Our M&A advisory includes valuation support, due diligence prep, deal structuring, and seamless handholding through every stage of the transaction or business exit process.

Not necessarily. We can work as your dedicated virtual CFO or complement your in-house finance and accounting teams. Our flexible model adapts to your internal structure and workload.

We ensure transparency through accurate reporting, structured dashboards, and strategic insights. This builds investor confidence and strengthens long-term relationships, key for scaling or securing future rounds.

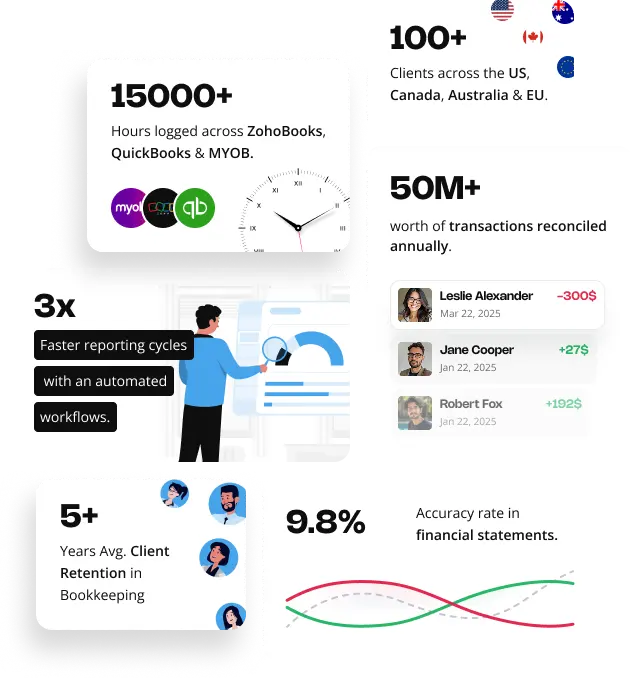

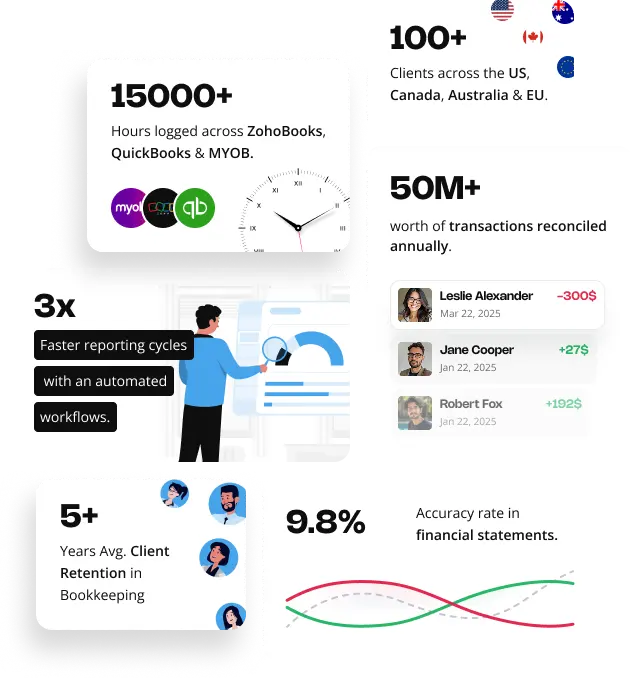

We use top-tier accounting and BI tools like QuickBooks, Zoho Books, NetSuite, Power BI, and Microsoft Dynamics. Our team selects tools that integrate seamlessly with your existing ecosystem for smarter insights.

If you’re facing scaling challenges, planning expansion, considering fundraising or exit, or need better financial visibility, you’re ready. A quick consultation can help you assess fit and potential impact.

Yes. We use encrypted cloud systems, role-based access, and follow global security standards such as GDPR, SOC2, and ISO practices. Confidentiality and data protection are non-negotiables.

Definitely. Whether you need more intensive support during a funding round or want to scale back after a transition, our services are flexible with no long-term lock-ins.

Simply schedule a consultation through our website. We’ll understand your financial needs, recommend a tailored approach, and get you started with a dedicated CFO advisor.

Connect quickly with:

Fill in the form and we will map out the smartest way forward.