Reduce Liabilities & Increase Savings with Smarter Tax Planning

Simplify your business taxes with tecHindustan. Our expert solutions help you maximize savings while ensuring seamless compliance.

Simplify your business taxes with tecHindustan. Our expert solutions help you maximize savings while ensuring seamless compliance.

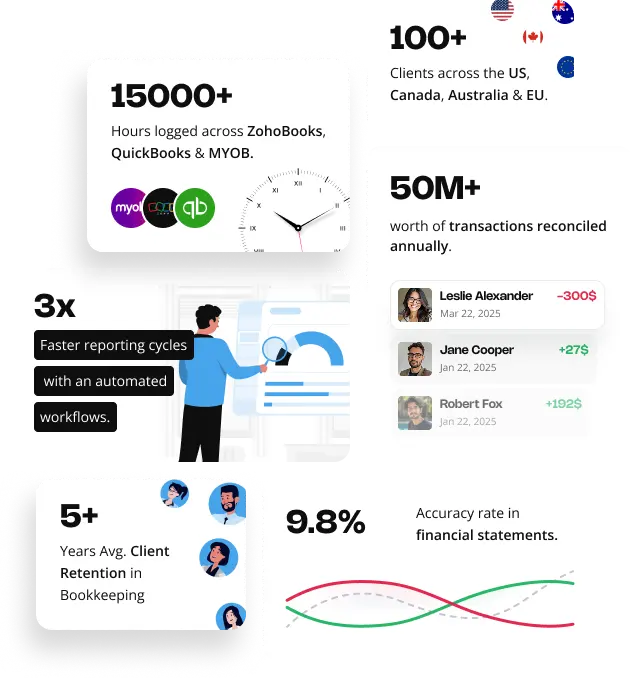

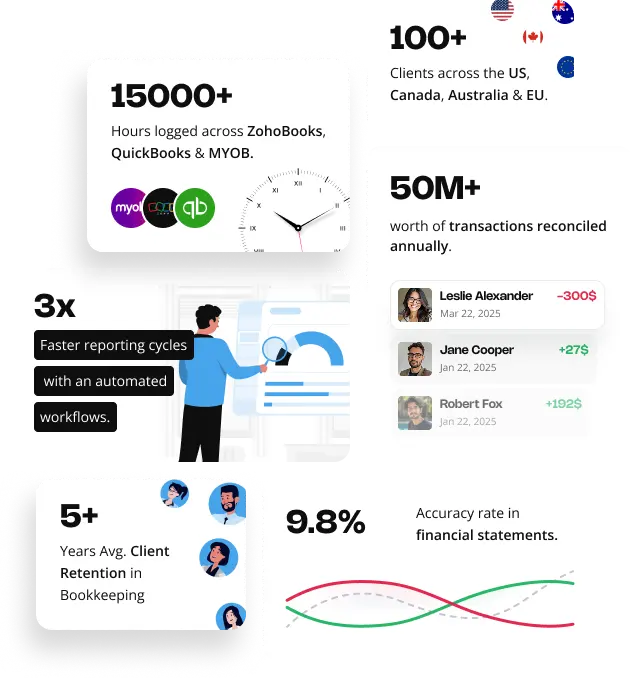

Tools We USe

tecHindustan offers comprehensive business tax services to strengthen your financial health. Our experts handle everything from strategic tax planning and compliance to accurate filing, ensuring your business meets regulations while maximizing savings. With a proactive approach, we help you minimize liabilities, reduce risks, and unlock valuable tax benefits for long-term success.

A strong tax strategy supports long-term success. Our experts analyze your business structure, income sources, and financial goals to create customized tax plans that reduce liabilities, improve cash flow, and boost profitability.

Stay compliant with confidence. tecHindustan helps businesses navigate complex tax regulations, minimize risks, and avoid penalties with accurate reporting, real-time monitoring, and timely tax submissions.

Make tax season stress-free with tecHindustan. We handle documentation, calculations, and filings, ensuring accuracy, compliance, and maximum deductions so your business can save money and focus on growth.

Don’t miss out on valuable tax credits. Our experts identify and secure eligible credits, improving cash flow and helping your business reinvest savings for greater financial success.

Your business structure affects your tax obligations. We analyze your setup and recommend strategic adjustments to reduce tax burdens, improve flexibility, and drive long-term growth.

Growing internationally? tecHindustan simplifies global tax complexities, ensuring compliance with foreign tax laws, reducing liabilities, and optimizing cross-border financial strategies.

Tax season made simple! Get our Business Tax Pack, featuring a pre-tax checklist, expert strategy guide, and an easy-to-use CPA workbook, helping you reduce risks and maximize savings.

From R&D credits to global tax strategies, our experts unlock every opportunity hidden in your numbers, so your business can grow smarter, faster, and stronger.

Get rewarded for innovation! Our R&D tax credit specialists help identify eligible expenses, ensuring you claim the maximum benefits while fueling business growth.

Dealing with a tax audit or dispute? Our experts provide strong representation and guidance to resolve issues smoothly while protecting your financial interests.

Expanding internationally? We help manage cross-border taxes, reduce double taxation, and create smart tax strategies to support your global business goals.

Improve cash flow by accelerating depreciation on real estate assets. Our cost segregation analysis helps you identify tax-saving opportunities and increase deductions.

Stay compliant while focusing on your mission. We assist non-profits with IRS-compliant tax filings, ensuring they meet all tax-exempt requirements effortlessly.

Take advantage of available tax breaks! Our experts identify government incentives that help lower costs, increase profitability, and support business expansion.

We handle your tax filings with precision, ensuring compliance with ever-changing regulations while minimizing the risk of penalties or errors.

Lower your tax burden with available credits. Our team analyzes your business operations to maximize savings and improve financial efficiency.

As your business evolves, so should your tax strategy. Our integrated accounting and tax teams work seamlessly to plan ahead, resolve issues, and ultimately save you money.

Our seasoned tax professionals provide proactive strategies to minimize liabilities and maximize deductions.

We align tax planning with your business goals, ensuring smooth coordination between accounting and compliance.

From accurate filings to real-time risk assessments, we help you stay ahead of changing tax regulations.

We identify tax credits, incentives, and deductions to help you retain more revenue.

In case of IRS notices or audits, we stand by your side, handling communications and ensuring the best outcomes.

Your financial data is protected with top-tier encryption, and our multi-step review process ensures error-free filings.

tecHindustan’s tax experts help you stay proactive, reduce liabilities, and maximize savings. We analyze your finances, anticipate tax obligations, and create optimized strategies to keep your business compliant and financially strong.

Gain instant access to up-to-date financial insights that empower smarter decision-making. Our real-time reporting and analytics provide a clear picture of your tax position, enabling you to optimize cash flow, forecast expenses, and plan strategically with confidence.

Streamline your tax processes with automation and expert support. Our efficient tax solutions reduce errors, eliminate redundancies, and enhance accuracy, ensuring smooth filings and timely submissions so you can focus on what matters, growing your business.

tecHindustan ensures your business remains tax-compliant, so you don’t have to stress over complex regulations. Our experts handle everything from strategy to filing, allowing you to focus on business growth without worrying about penalties, audits, or missed opportunities.

As your business grows, so do your tax needs. Our flexible tax solutions scale with you, ensuring seamless financial management whether you're a startup, mid-sized firm, or multinational enterprise. We adapt strategies to match your evolving business goals.

Keep more of what you earn with our tax-saving strategies. We identify deductions, credits, and cost-cutting opportunities customized to your business, helping you reduce liabilities and reinvest savings into growth, innovation, and financial stability.

Protect your financial data with industry-leading security measures. We use advanced encryption, secure cloud solutions, and compliance-driven protocols to safeguard sensitive tax information, ensuring confidentiality and peace of mind for your business.

Our tax experts decode the fine print so you can focus on scaling smart.

tecHindustan made things so simple. Their streamlined process and sharp financial acumen have led this process effortlessly, without us having to worry about it.

Couldn’t have asked for more!

Synergy Enterprises

I never thought these simple financial tasks were eating away my time and resources like anything.

The moment I delegated this responsibility to techHindustan, I freed up a significant amount of time for my other important tasks, which led me to succeed in multiple ventures.

I highly recommend their services!

CEO, Medistik

tecHindustan has completely transformed the way we handle payroll. What used to be a time-consuming and stressful process is now smooth and hassle-free. Thanks guys!

CEO, Emerald Planet

Outsourcing payroll to tecHindustan was the best decision ever. It not only took the workload off our plate but also ensured greater precision and efficiency.

Creative Minds Agency

Empower your business with advanced financial management. From expert virtual bookkeeping services to strategic financial guidance, we provide the tools and insights you need to thrive in today’s digital economy.

You need a partner who can steer you through pivotal moments. Through budgeting and forecasting, cash flow management, and strategic planning, our CFOs ensure your financial strategy is effective.

Maintain financial accuracy and compliance with ease. Our accounting solutions ensure audit-ready financial reporting, error-free reconciliation, and seamless compliance management to support your business growth.

Minimize stress, save time and money, and impress stakeholders with streamlined accounting operations managed by your dedicated tecHindustan team.

Streamline your payroll with accurate and compliant processing that ensures your team gets paid on time every time without the stress.

We’ve clarified your common questions to help you make informed decisions and have a hassle-free experience.

Business tax services cover tax planning, preparation, filing, and compliance. tecHindustan ensures you meet every regulatory requirement, minimize tax liabilities, and stay audit-ready—whether you operate in the US, UK, UAE, Australia, or India.

Outsourcing to tecHindustan means fewer errors, zero last-minute rush, and proactive tax strategies from experts who understand global tax systems. You focus on growth—we handle the tax stress across all jurisdictions.

Yes. We assess your business structure, expenses, and eligible credits to identify lawful ways to reduce your tax burden. Our goal is to ensure full compliance while maximizing your savings.

Our tax experts monitor global tax regulations and region-specific changes across the US, UK, India, UAE, Australia, and Canada. We update your filing and strategy accordingly to keep you 100% compliant.

Absolutely. We specialize in handling tax obligations for businesses with operations across multiple countries. From VAT (UAE/UK) to GST (Australia/India) and corporate taxes (US/Canada), we’ve got you covered.

We offer tailored tax services for FinTech, SaaS, IT, e-commerce, healthcare, and retail. Whether you’re a US-based software firm or a UAE-based trading company, we align your tax strategy with your business model.

Yes. We guide startups through their early-stage tax obligations—entity selection, quarterly filings, deductions, and investor reporting. tecHindustan makes compliance easy, right from day one.

Yes, we provide end-to-end audit support. If your business faces a tax audit or receives a notice, our team prepares documentation, communicates with tax authorities, and helps resolve issues efficiently.

Data security is non-negotiable. We use encrypted systems, secure cloud platforms, and strict access controls, ensuring your sensitive tax data is protected and compliant with GDPR, SOC2, and global standards.

We provide year-round support. From quarterly advance tax calculations to year-end filings, tecHindustan ensures you’re always prepared—no tax surprises, just proactive planning.

We’re proficient in tools like TurboTax (US), TaxSlayer, Zoho Books, QuickBooks Tax, Tally, ClearTax (India), Xero Tax (UK/AU), and more. We use region-specific tools for speed, accuracy, and compliance.

Definitely. We identify eligible tax credits—R&D credits, startup incentives, ESG rebates, and regional schemes—to lower your effective tax rate. We ensure you don’t leave money on the table.

We combine 9+ years of digital-first experience with deep tax expertise. Our team brings together automation, AI insights, and international compliance knowledge—making us a modern partner for your tax needs.

Our pricing depends on your business size, location, number of filings, and complexity. We offer transparent, competitive global rates—ideal for startups, SMEs, and fast-growing enterprises.

Need a tailored quote? Talk to us here.

Simply contact us through our website. We’ll schedule a discovery call to understand your needs, review your current tax structure, and recommend the best service plan for your business and region.